ADM Settles FCPA and Economic Sanctions Charges

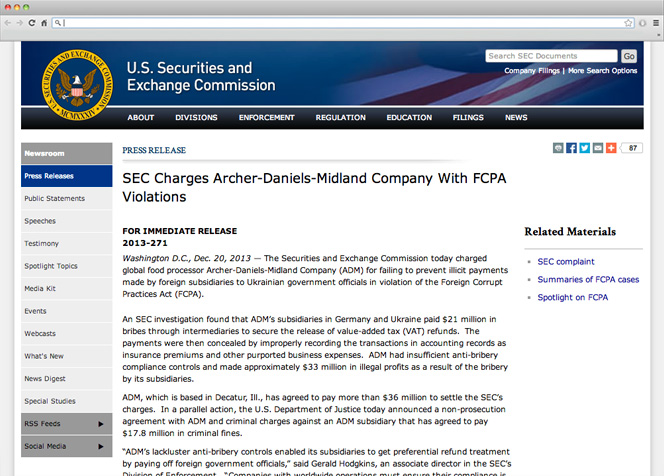

Summary: On December 20, 2013, NYSE-listed, ADM, one of the world’s biggest agricultural traders and processors, agreed to pay a total of US$54.3 million to the U.S. Securities and Exchange Commission (SEC) and the U.S. Department of Justice (DOJ) to resolve civil and criminal charges that subsidiaries bribed government officials in Ukraine to obtain value-added tax (VAT) refunds in violation of the FCPA.

Allegations: The SEC alleged that in order to obtain the VAT refunds that the Ukraine government was withholding, ADM subsidiaries in Germany and Ukraine devised several schemes in the years 2002-2008 to pay third-party vendors to pass on bribes to Ukraine government officials to release the money. The payments were allegedly concealed by improperly recording the transactions in accounting records. For example, in one case, the subsidiaries allegedly artificially inflated commodities contracts with a Ukrainian shipping company to provide bribe payments to government officials. In another case, the subsidiaries allegedly created phony insurance contracts with an insurance company that included false premiums passed on to Ukraine government officials.

According to the SEC, the misconduct went unchecked by ADM for several years, because of its deficient and decentralized system of FCPA oversight over subsidiaries in Germany and Ukraine.

“ADM’s lackluster anti-bribery controls enabled its subsidiaries to get preferential refund treatment by paying off foreign government officials,” said Gerald Hodgkins, an associate director in the SEC’s Division of Enforcement. “Companies with worldwide operations must ensure their compliance is vigilant across the globe and their transactions are recorded truthfully.”

Factors Influencing the Outcome: The SEC and the DOJ acknowledged ADM’s extensive cooperation throughout the investigation. These efforts included conducting a world-wide risk assessment and corresponding global internal investigation; self-reporting the matter; implementing a comprehensive new compliance program throughout its operations; making numerous presentations to the Government on the status and findings of the internal investigation; voluntarily making current and former employees available for interviews, terminating employees involved in the misconduct; compiling relevant documents; taking early and extensive remedial efforts.

The settlements also require the company to report on its FCPA compliance efforts for a three-year period and to continue implementing enhanced compliance programs and internal controls designed to prevent and detect FCPA violations. ADM’s German subsidiary also paid an unspecified penalty to German authorities.